Planning Your 2021 Investment Budget: Opportunities in China

As businesses prepare their 2021 investment budgets, investing in China is still the top choice for foreign firms.

Having suffered through the worst of the outbreak in the initial months of 2020, China emerged stronger and more resilient, reflected in its disease control strategies, policy priorities, and support for the private sector.

After businesses and factories reopened and internal movement relaxed following the successful implementation of COVID-19 control measures, China proved itself to be a reliable investment destination.

China’s economic outlook

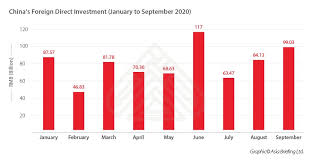

According to official data released by China’s Ministry of Commerce, foreign direct investment (FDI) into China rose by 5.2 percent year-on-year to RMB 718.81 billion (US$107.2 billion) in the first nine months of 2020, with 22,602 foreign-invested enterprises (FIE) having newly established by the end of August. In September alone, FDI inflows into China reached RMB 99.03 billion (US$14.25 billion), up by 25.1 percent, as compared to the same period last year. Leading multinational companies, such as ExxoMobil, BMW, Toyota, and Invista, increased their investment into China.

The 9th China Insurance International Summit 2021

The 9th China Insurance International Summit 2021 will be launched in Hainan with the theme of“ Opening Up for Co-Prosperity, Innovation Leading to the Future”. It aims to cooperate with global insurance companies under the premise of financial opening policy and free trade port construction. Together, industry leaders will explore new opportunities for the development of the insurance industry and embark on a new journey for the development of the insurance industry!

Corporate Budget Planning 2021: Disruptions, China’s Consumer Market, Emerging ASEAN, the Digital RMB, and BRI Hot Spots

Dezan Shira & Associates held a virtual partners’ meeting yesterday to discuss planning for 2021. Our firm – which has been assisting foreign investors in Asia since 1992 and now has close to 30 regional offices and staff running into hundreds – has dealt with billions of dollars’ worth of regional foreign investment during this time. We are, of course, foreign investors ourselves, and with an Asian geographical spread and corporate client base of the type we have, are a bellwether for how foreign investment trends are progressing in the region, especially as the bulk of our clients are from North America and Europe.

Obviously 2020 took planned corporate budgets by surprise, chewed them up and spat them out in a COVID frenzy of radically altered expectations. Sales targets have been dumped, production facilities mothballed, and staff told to work from home. Yet, at the same time, corporate spending has decreased, meaning for many a reduction of revenues that has been offset by a reduction in expenses. Economically, things have not been as bad as they could have. But where does this leave businesses when trying to plan for 2021?

Clearly, the COVID factor is not going to disappear any time soon. While 10 months on we may have a greater understanding of how the virus operates, and how social discipline can hinder its spread – there is no realistic timeline in sight for a workable vaccine. Bill Gates, financing much of the research, has suggested this year end, while Dr. Anthony Fauci, the United States’ primary medical advisor, has suggested any preventative vaccine will not be widely available until the second or third quarter of 2021. As of right now, no widely tested vaccine is available, although both China and Russia are progressing with clinical trials. What this means is that while vaccines might be ready later this year, getting them out to the global population is going to be a massive supply chain issue. It is unrealistic that any significant progress will be made until well into 2021, and even then, new cases and spikes will emerge over the coming months and into the new year. The best one can suggest in terms of business preparedness is that 2021 will again be disruptive. That means careful, considered budgetary planning is essential as we start to assess how to structure business finances leading into the next year. However, there are some predictable and even bright spots that corporate financiers can take into consideration when looking at potential for 2021.

China Cutting EV Subsidies In 2021 To Boost Local EVs

China plans to cut subsidies for New Electric Vehicles (NEVs), hybrids, and hydrogen fuel cell vehicles in a bid to boost homegrown EVs while making it harder for foreign EV companies to market their vehicles in the largest auto market in the world.

How to Apply for a Credit Card in China

- Your valid passport and visa, with copies of them

- Residence permit or work permit

- Steady job in China

- You are at least 25 to 60 years of age

- Proof of personal finances: real estate certificate, certificate of tax payments, cash flow statement, income statement, certificate of employment

Although the application form will most likely be in Chinese, provincial headquarters and city centre branches that are bigger will provide an English speaking service, which will make your application smoother.

Not all banks are as willing to create accounts for foreigners, however, the most renown banks will typically be more open to creating an account for foreigners. Some of the most sought out banks are:

- Industrial and Commercial Bank of China (ICBC)

- Agricultural Bank of China (ABC)

- China Construction Bank (CBC)

- Bank of China (BOC)

- Bank of Communications

China’s Economy Set for More Pain in 2020 as Growth Forecast to Sink Further

China’s economic growth could drop below 6% next year for the first time since 1990 as the world’s second-largest economy continues to be affected by the trade war with the U.S. and cooling infrastructure investment, UBS Wealth Management forecasts.

Real gross domestic product (GDP) is set to increase by just 5.7% in 2020, according to Hu Yifan, regional chief investment officer and chief China economist at UBS Wealth Management, a unit of Switzerland-based banking group UBS AG. That compares with an estimated 6.1% in 2019 and would mark the third straight annual slowdown.

China’s GDP growth slipped to 6.6% in 2018 from 6.8% the previous year, and was 6.2% year-on-year in the first nine months of 2019, the National Bureau of Statistics said in October.

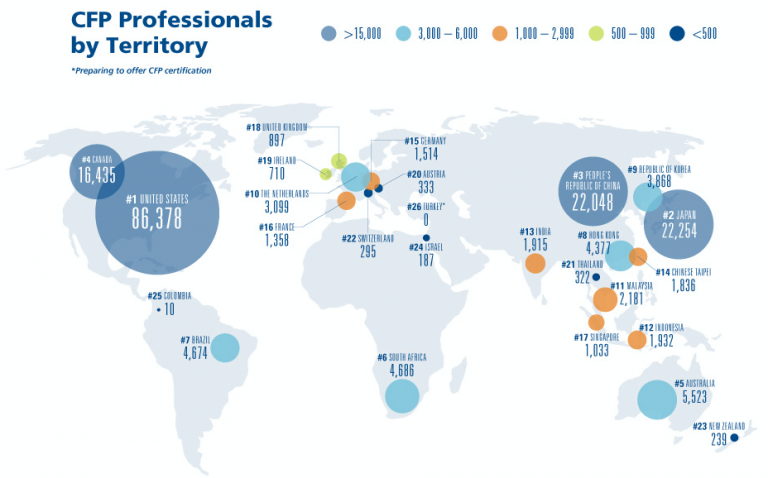

Financial Planning Standards Board Reports Record Number of CERTIFIED FINANCIAL PLANNER Professionals Worldwide

DENVER, CO – 25 FEBRUARY 2020 – Financial Planning Standards Board Ltd. (FPSB), owner of the international CERTIFIED FINANCIAL PLANNER certification program outside the United States, reported another year of growth for the global CFP certification program in 2019, as the total number of CFP professionals worldwide rose to 188,104. With a net increase of 6,744 CFP professionals over the previous year, FPSB and its global network of affiliate organizations grew the global CFP professional community by 3.7% last year, for an average percentage growth rate of 3.6% over the past five years.

“Financial Planning Standards Board is pleased to see continued strong interest among financial advisors and financial planners in pursuing CFP certification, the global symbol of excellence in financial planning,” said Noel Maye, CEO of FPSB. “FPSB is committed to supporting members of the public in their efforts to identify and work with competent, ethical financial planners who put their clients’ interests first. Having a large and growing community of CFP professionals worldwide committed to providing advice and services in an ethical and professional manner will support

Yield-crazed investors pile into US subprime car loans

ABS are motoring despite weakening consumer economy and rising delinquencies

Featured All Home Loans

- Flexible repayment options

- Profit rate as low as 3.80%

- Lower monthly repayments

Best China SIM Cards | Ultimate 2020 Guide

How can you get China SIM cards? And which China SIM card is best? While some travelers have the option to activate the international roaming on their home country phone plans, that’s either really expensive or not a good option for those who will be in China long-term. The best solution is to get your own Chinese SIM card. Read below to learn how to get a SIM card in China as well as some crucial tips on which SIM card is best.

The Hilton Honors American Express Business Card

Earn up to 100,000 Hilton Honors Bonus Points. Earn 75,000 Bonus Points after you spend $3,000 in purchases on your Card in the first 3 months of Card Membership, and 25,000 Bonus Points after you make another $1,000 in purchases on your Card in your first 6 months. Earn Hilton Honors Bonus Points for each dollar of eligible purchases on your Card: 12X at hotels and resorts in the Hilton portfolio, 6X on Select Business &Travel Purchases, 3X Everywhere Else. Terms & Limitations Apply. Enjoy complimentary Gold status with your Hilton Honors Business Card. ‡ Earn a Weekend Night Reward from Hilton Honors after you spend $15,000 in purchases on your Card in a calendar year. ‡ Earn another Weekend Night Reward from Hilton Honors after you spend an additional $45,000 in purchases on your Card in the same calendar year. ‡ Relax with 10 free airport lounge visits each year once enrolled in complimentary Priority Pass™ Select membership, which offers access to over 1,000 lounges in over 120 countries. ‡ Terms apply.

Starwood Preferred Guest® Business Credit Card from American Express

Earn a $100 statement credit after you make $1,000 in purchases on the Card within your first 3 months of Card Membership. Plus, earn an additional $100 statement credit after your first purchase on the Card at a participating SPG® or Marriott Rewards® hotel within your first 6 months of Card Membership. From now through July 31, 2018: Earn 2 Starpoints® for every dollar of eligible purchases on the Card at participating SPG® and Marriott Rewards® hotels. Earn 1 Starpoint for all other eligible purchases. Note: On August 1, 2018, SPG will convert every one Starpoint in a loyalty member account to three points. In general, corresponding redemption changes will occur. Visit members.marriott.com for details. Effective August 1, 2018: Earn 6 points for every dollar of eligible purchases on the Card at participating SPG® and Marriott Rewards® hotels. Earn 4 points at U.S. restaurants, U.S. gas stations, wireless telephone services purchased directly from U.S. service providers, and on U.S. purchases for shipping. Earn 2 points for all other eligible purchases. No Foreign Transaction Fees on international purchases and $0 introductory annual fee for the first year, then $95.

Gold Delta SkyMiles® Credit Card from American Express Earn 30,000 Bonus Miles and $50.

Earn 30,000 Bonus Miles after spending $1,000 in purchases in the first 3 months and a $50 statement credit after making a Delta purchase in the first 3 months with your new Card. Earn 2 miles for every dollar spent on eligible purchases made directly with Delta. Earn 1 mile for every eligible dollar spent on purchases. Check your first bag free on Delta flights - that's a savings of up to $200 per round trip for a family of four. Settle into your seat sooner with Priority Boarding. Enjoy a $0 introductory annual fee for the first year, then $95. Terms Apply.