How To Simplify Your Investing In 2020

I would like to let you in on a little research I have been doing. It has to do with identifying what matters in creating investment portfolios today. The other side of that is, of course, determining what does not matter, given the dramatic changes in how markets work versus a decade ago.

It is also vital to identify and avoid retirement-killing features of your portfolio. Given the stage of the stock and bond cycles we find ourselves in, they are everywhere. That’s why separating what is valuable from what is not is so critical now. First, a quick background.

So easy, a caveman can do it?

One of the biggest changes in the way we invest today is how simplified it all is. Robo-Advisors like Robinhood, Betterment and their peers make it very easy to get started. They also boil investment success down to a tidy process you can do yourself. Pop your money in an S&P 500 Index Fund, go Rip Van Winkle for 20 years, and wake up to riches beyond your dreams.

For some people, the possibility of that is all they need. That, and the decision by Schwab and other big brokers to eliminate commissions on equity and ETF trades has essentially taken the obvious costs out of investing.

2020 insurance outlook

?As insurance firms adapt to maturing markets and economic turbulence, in the long run, their ability to integrate technology, talent, and business-model innovation into legacy environments may be the key to success.

How this clever Japanese method could transform your savings account

The kakeibo method is like a bullet journal for your finances. Here's how to use it to save money and spend less in 2020.

Japanese banks heighten riskier lending to offset profit crunch

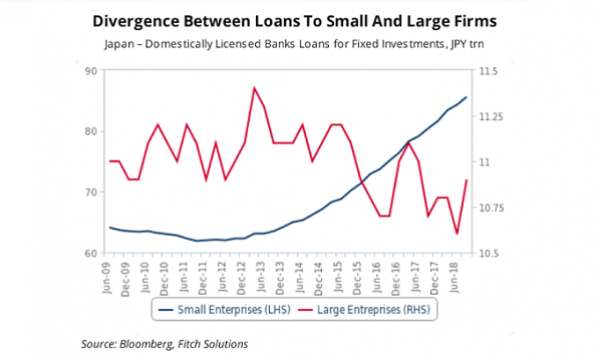

Lending to small enterprises is on a steady rise since 2013.

Japanese banks have been ramping up risky lending practices in a desperate bid to turn a profit as lenders increase loans to riskier small enterprises even as loans to larger firms have been on a decline, according to Fitch Solutions.

The aggressive risk-taking practices of Japanese banks stems from the prevailing low-interest rate environment engineered by the central bank which weighs in on the margins of the banking sector. Banks that are actively engaed in such activities face the risk of higher credit risk which could 'aggravate losses in the case of a slowdown or recession.'

Also read: Japanese banks risk-taking hits near 30 year high in 2018

"As long as monetary policy remains loose and yields low, Japanese banks should maintain their active lending attitude, especially towards riskier firm in order to generate some profits. That said, the BoJ has adopted a more flexible approach to its quantitative easing programme with the yield curve control (YCC) by allowing yields to trade marginally higher which should somewhat support banking profits," Fitch Solutions said in a report.

As a result, capital adequacy ratios have been declining since 2012 with the research firm expecting sudden reversal in the downtrend in the short to medium term.

4 Banks that Offer Home Loans in Japan to Non-Residents

Let’s be honest; it can be pretty darn tricky to get a home loan in Japan as a Japanese citizen, let alone as a foreigner. With countless stacks of paperwork, residency requirements, and rigorous background checks, it’s not surprising that most foreigners tend to fall short of Japan’s mortgage requirements. While we won’t be able to increase your salary or length of time on the job to help you qualify for an overseas property loan, there is one thing this article may be able to help you work around: Japan’s residency requirement.

Ah, the dreaded residency requirement—who’d have thought the majority of Japanese banks would actually require you to live in Japan before they give you money! Shocking, right? Well, as most foreign investors have found out, Japanese banks are pretty strict when it comes to lending money to those not planning to live in good old Nippon, no matter how large their income might be. In this article, we’ll point you in the right direction to obtain an overseas loan for real estate in Japan without living there.

Using Credit Cards In Japan - A Guide To Money During Your Trip

One thing that may run through many peoples' minds before an international trip is this: "Will I be able to use my credit card?” Credit cards can of course be used in Japan. However, the usage rate of credit cards here is low when compared to other developed nations and Western countries.

In Japan, there are many instances where credit cards can’t be used depending on the location. As such, we have created a guide on places where credit cards are able to be used and what to do when you run out of cash.